Qualified Plan Contribution Limits 2024

Qualified Plan Contribution Limits 2024. The irs increased the 401(k) limits for 2024 to $23,000. If a taxpayer contributes more than the allowed amount to certain tax.

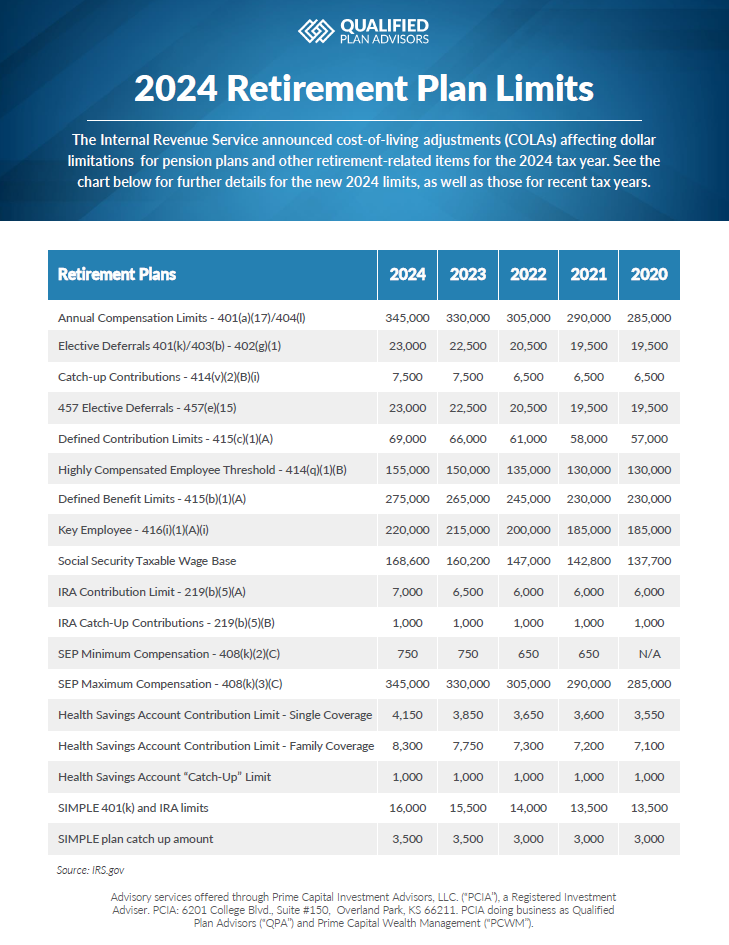

Irs releases annual increases to qualified retirement plan limits for 2024. Contribution limits for 401 (k)s and other defined contribution plans:

The Updated Limits For 2024, As Compared To Last Year’s Limits, Are Set Forth In The Charts Below.

On november 1st, the irs.

The Figures Cannot Be Finalized Until After The.

401 (k) pretax limit increases to $23,000.

The Dollar Limitations For Retirement Plans And Certain Other Dollar Limitations That Become Effective January 1, 2024, Have Been Released By The Irs In.

Images References :

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Contribution limits for 401 (k)s and other defined contribution plans: 401 (k) pretax limit increases to $23,000.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Deferral up to $23,000 ($30,500 if age 50 or over) 7. The limitation on the annual benefit for a defined.

Source: qualifiedplanadvisors.com

Source: qualifiedplanadvisors.com

2024 Retirement Plan Limits Qualified Plan Advisors (QPA), For 2024, the adjusted gross income limitations have increased from $73,000 to $76,500 for married filing jointly filers; 2024 retirement plan maximums and limits/saver's credit.

Source: ebn-design.com

Source: ebn-design.com

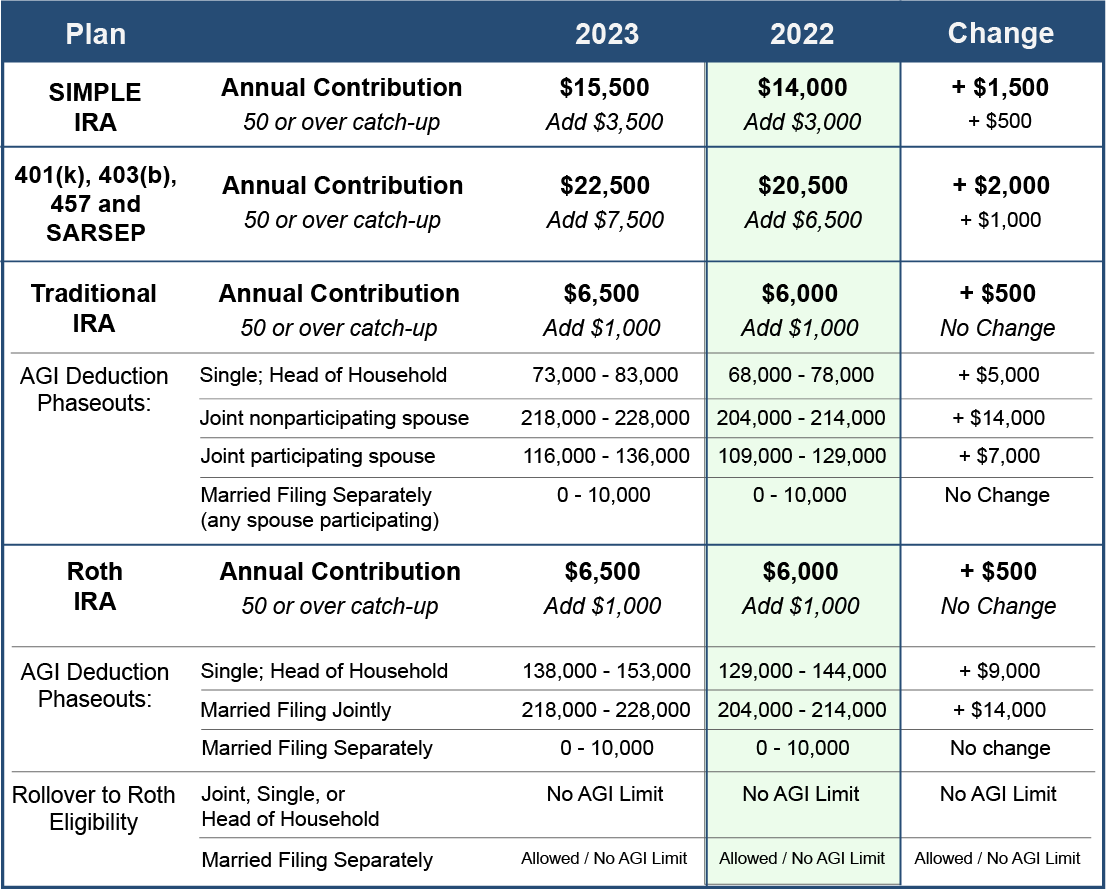

Qualified Plan & IRA Contribution & Catch up limits Executive, Qualified defined contribution plan maximum contribution. An individual is provided with a lifetime tax exemption for capital gains realized on the disposition of qualified small business corporation shares and qualified farm or fishing.

Source: blog.velisabookkeeping.com

Source: blog.velisabookkeeping.com

Plan Your 2023 Retirement Contributions Velisa Bookkeeping Services LLC, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403. Irs releases the qualified retirement plan limitations for 2024:

Source: www.portebrown.com

Source: www.portebrown.com

New 2022 IRS Retirement Plan Limits Announced, The irs increased the 401(k) limits for 2024 to $23,000. Elective compensation deferrals, such as 401.

Source: www.marinerwealthadvisors.com

Source: www.marinerwealthadvisors.com

Discover the Benefits of Establishing a 401(k) over a SEP or Simple IRA, If a taxpayer contributes more than the allowed amount to certain tax. The figures cannot be finalized until after the.

Source: www.jdsupra.com

Source: www.jdsupra.com

Retirement Plan Contribution Limits Will Increase in 2020 Ward and, Deferral up to $23,000 ($30,500 if age 50 or over) 7. The 401 (k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Source: www.carboncollective.co

Source: www.carboncollective.co

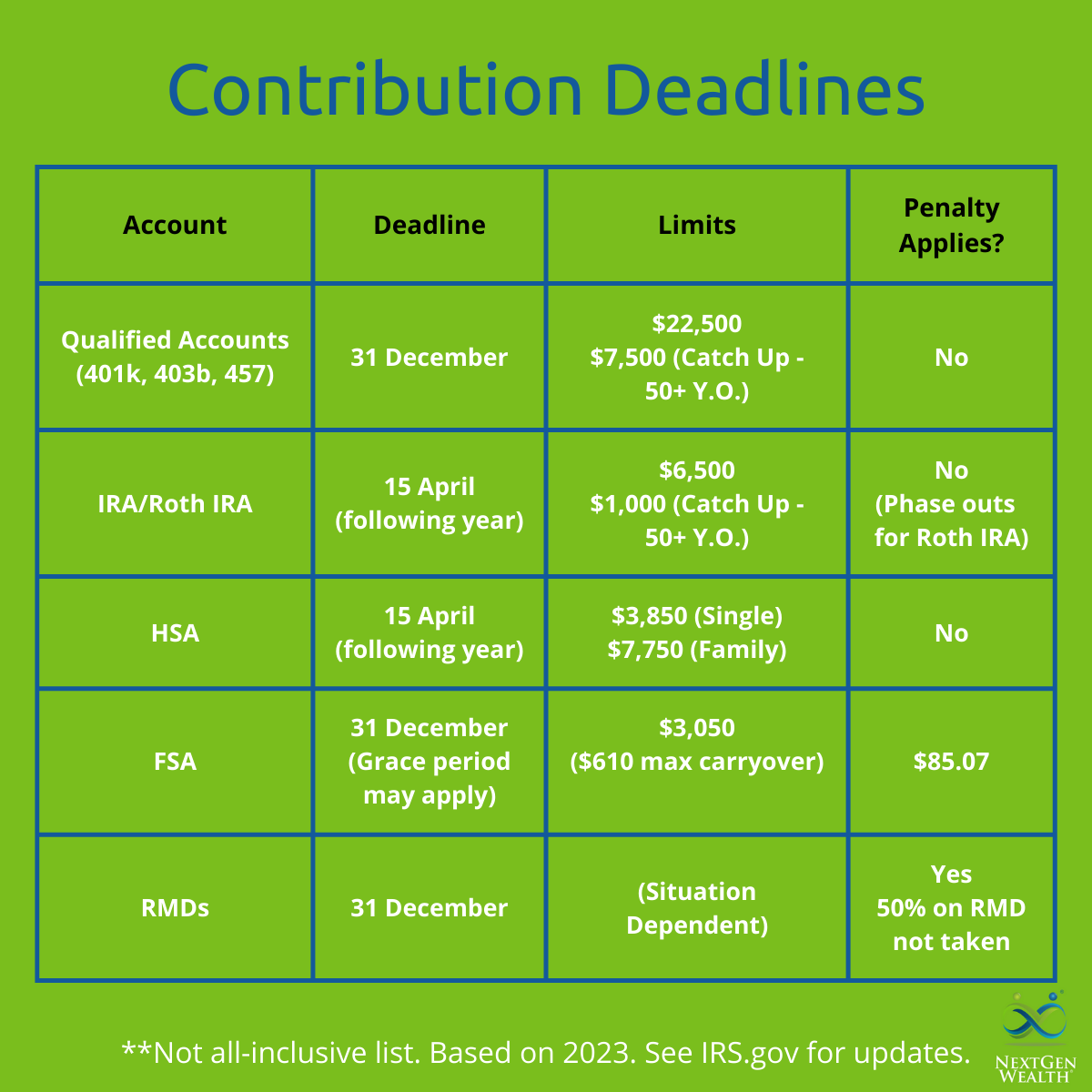

Qualified Retirement Plan How It Works, Investing, & Taxes, Irs releases 2024 qualified benefit plan limits. Irs releases annual increases to qualified retirement plan limits for 2024.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

Important Retirement Plan Contribution Deadlines for 2023, The irs increased the 401(k) limits for 2024 to $23,000. Elective compensation deferrals, such as 401.

If A Taxpayer Contributes More Than The Allowed Amount To Certain Tax.

Qualified defined contribution plan maximum contribution.

From $54,750 To $57,375 For Head Of Household Filers;

The annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000).